Attorneys for All Victims of Uber and Lyft Accidents.

At Yerushalmi Law Firm we fight for Uber and Lyft drivers, passengers, and third-party pedestrians who were hit by an Uber or Lyft. We are familiar with Uber and Lyft’s complex policies. More importantly, we have been successful fighting and winning against Uber and Lyft.

If you or a loved one has been injured in an Uber of Lyft accident, it is imperative that you call an Uber or Lyft injury attorney who has experience fighting and winning against these multi-billion-dollar companies. We provide a free, zero obligation, consultation and work on a contingency fee basis thereafter- which means you don’t pay unless we win. You can call or text us now at (310) 777-7717.

What You Need to Know About Uber and Lyft Accident Policy.

Uber and Lyft are both multi-billion-dollar, publicly traded companies with a lot on the line when their drivers are involved in an accident. As such, they have a substantial insurance policy to protect the company in the event an accident occurs. For example, it is well known that Uber drivers are covered by $1 million in liability and uninsured/underinsured motorist coverage.

What most Uber riders, drivers and even most Uber Attorney’s do not know is that Uber has at least another $100 Million available in excess coverage when their drivers are at fault, and it is likely that they have excess policies when it comes to uninsured and underinsured motorist as well. In comparison, many ordinary drivers in California carry only $15,000 in injury liability.

Uber Insurance and Lyft Insurance Coverage Explained.

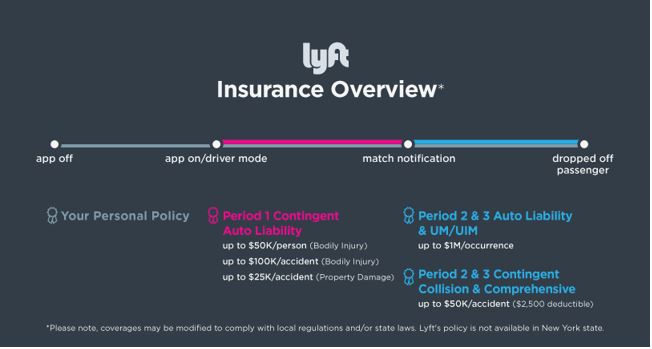

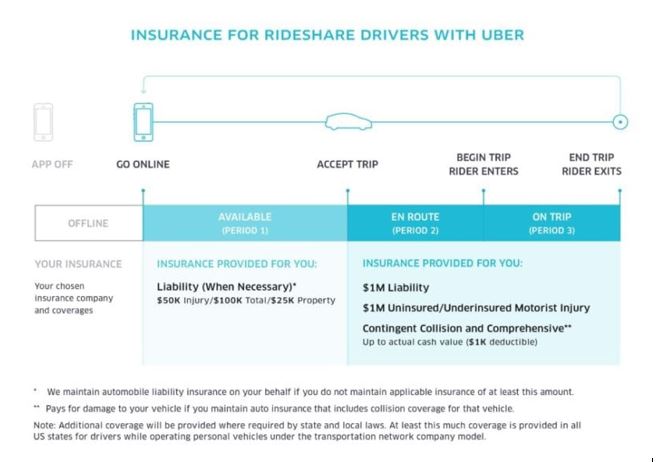

Which type of insurance coverage is available for a particular Lyft or Uber accident victim depends on what the driver of the Uber or Lyft was doing when the accident occurred. In general, there are three liability limits which a Lyft or Uber driver may have when he or she:

- Was not logged into the app but was driving on his or her own time.

- Was logged in to the Lyft or Uber App and was waiting for a passenger to match with.

- Already matched with a passenger or picked someone up.

Uber and Lyft only provide full coverage during periods 2 and 3. The driver of the Uber is responsible to purchase his or her own insurance policy for instances when they are using the car as they regularly would.

As seen Above, Lyft and Uber divide insurance coverage into three separate time periods for their drivers.

No Period: This is when the driver is “off the job” and not logged into the app. During this period, the driver is using the same car he or she typically uses for Uber or Lyft for personal reasons. Any claims arising from an accident during this period will be covered by the driver’s personal insurance policy.

Period 1: This is when the driver is logged into the app and waiting to match with a passenger. When there is an accident during this period, Uber and Lyft have 50/100/25 liability coverage. This means that the liability limits are $50,000 per person and $100,000 total per accident involving bodily injury, and $25,000 for property damage. Further, during this period, insurance coverage for the driver does not apply (uninsured, underinsured, medical payments) or for driver’s vehicle (collision) during this gap period.

Period 2: This is when the Uber or Lyft driver has accepted a fair on the app and is on the way to pick up a passenger. During this period, Uber and Lyft offer $1 million in liability, uninsured and underinsured coverage. This is also the period where Uber’s $100 million+ and Lyft’s undisclosed excess policies, which most Uber and Lyft attorneys are unfamiliar with, apply. Collision coverage is still under the driver’s personal insurance policy.

Period 3: This is when the Uber or Lyft driver picked up the costumer and is in route to a destination. During this period, Uber and Lyft offer $1 million in liability, uninsured and underinsured coverage. This is also the period where Uber’s $100 million+ and Lyft’s undisclosed excess policies, which most Uber and Lyft attorneys are unfamiliar with, apply. Collision coverage depends on whether the driver already has collision coverage as well.

What Should You Do if You Have Been Involved in an Uber or Lyft Accident?

Uber and Lyft are notorious for being hard to reach by phone. They also have the wealth and resources to employ armies of investigators, experts, and other professionals whose sole job is to find a way to deny your claim and protect the company’s profits. At Yerushalmi Law Firm, we have the knowledge and resources to touch base with Uber and Lyft. In addition, we are skilled negotiators and aggressive trial lawyers who have been successful working with Uber and Lyft in the past.

We understand that Uber and Lyft accident claims can be very confusing, and we are here to help you get your vehicle repaired or replaced, get your medical bills paid, and most importantly maximize your Uber of Lyft injury claim. Call us today at (310) 777-7717 for immediate assistance.